Tell us the destination. We’ll lead the way.

Our journey together begins with the simple act of listening. We want to understand your hopes, fears, ambitions, motivations, and dreams—for yourself as well as for future generations. Deep understanding is essential in creating a fruitful and enduring relationship that will position your family and your legacy to flourish for generations to come.

As we develop the path together, we move forward collaboratively and transparently, establishing a foundation of open communication and trust. It’s why we always seek to serve on a fixed fee and retainer model. We don’t want anything inhibiting our dialogue along the way to fulfilling your vision.

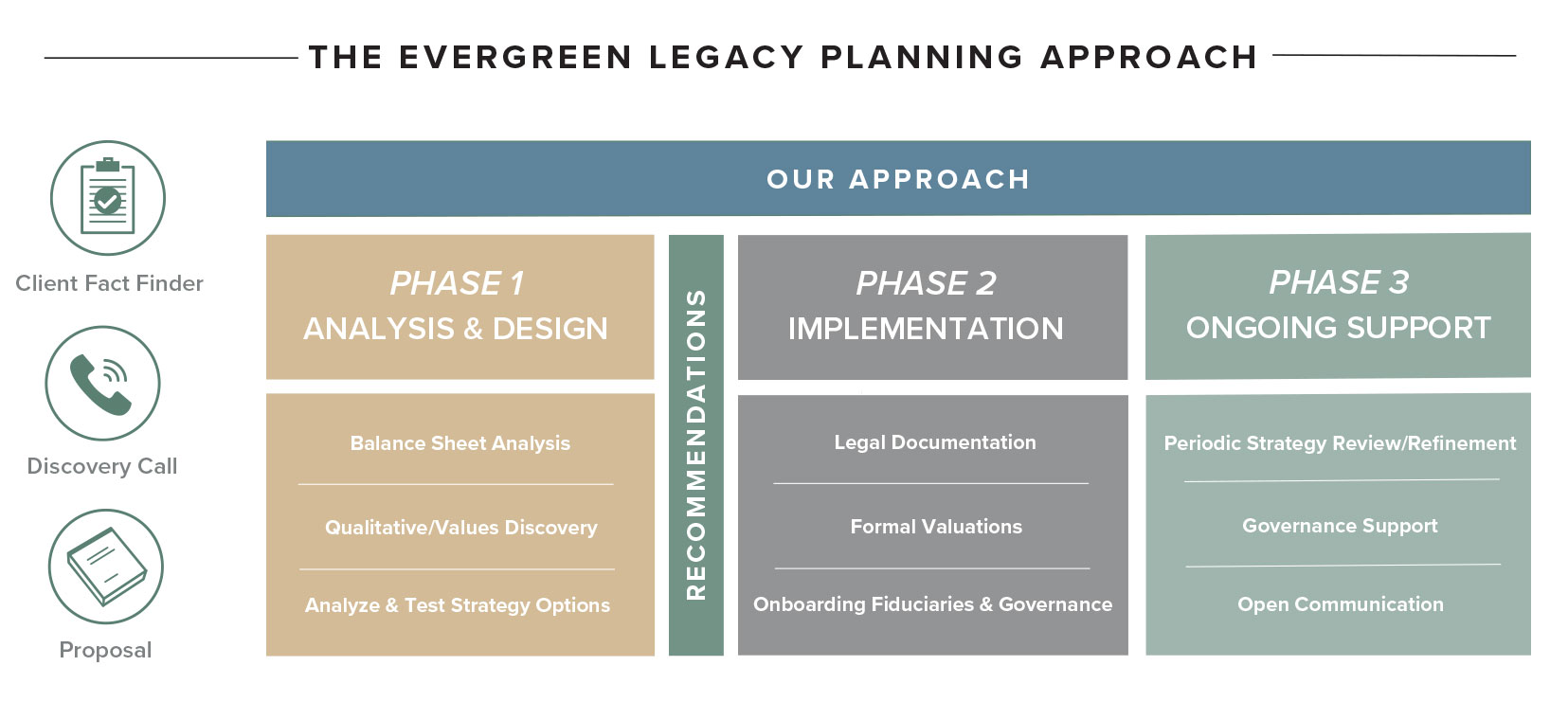

PHASE 1

Discovery, Analysis & Strategic Design

If you don’t care where you’re going, any path will get you there.

With so many issues to think about, estate planning can be overwhelming. Tax reduction—both today and in the future. Managing complex assets. Providing for your spouse or partner. Balancing freedom and financial protection for the people you love. Creating a family wealth management system that brings family closer together instead of pulling them apart. Helping future generations achieve their greatest potential. Making the world a better place with intentional philanthropy. These and many other priorities are all competing for your attention.

Through deep discovery, careful analysis, and thoughtful consideration we first work with you to help you confidently establish a destination worth going to. The first phase of our engagement is dedicated to that process.

We start by understanding as much as possible about your concerns and priorities. We analyze the current state of your balance sheet, existing legal structures and any tax or other concerns and measure our findings against the goals you’ve established. Because we work on a fixed fee and retainer model, we seek open communication with you. This is an iterative process that usually requires some back-and-forth as we gain deeper understanding of your goals and as your priorities become more refined. We don’t charge our clients for calls or emails because the more we understand about you and your needs, the more likely we are to develop legal strategies that accomplish your objectives.

With your permission, we will work with your other advisors to make sure everyone is on the same page. Because we don’t do accounting, we don’t sell insurance, and we don’t give financial advice, we don’t compete with any of your other advisors. But through our strategic review and analysis we often find opportunities for you to improve your financial efficiency through strategic legacy planning.

To get started, download our pre-planning fact finder.

Matt’s broad range of experience and thoughtfulness gave me peace of mind knowing he was truly interested to see our business succeed and in a way that protects me, my business partner, and my family.

J. H.

PHASE 2

Strategy Refinement & Implementation

This is where your strategy becomes action. After developing an overarching strategic plan, we tailor the strategies as appropriate and begin implementing them. The implementation phase usually includes several interrelated legal strategies, often including multiple trusts (potentially in more strategic jurisdictions), one or more limited liability companies, and a lot of complex paperwork to document your strategic legal plan. This part can seem overwhelming for many people, so we walk through your strategies with you and present it as simply and clearly as possible.

If your plan requires additional tax preparation, appraisals, asset retitling, or other steps, we will review that with you (and with your CPA, if you’d like). We will help you understand the process of maintaining each of the strategies and discuss how to manage your plan going forward to make sure it stays in sync over time. If you allow us, we will work collaboratively with your tax advisor, insurance advisor, and financial advisor to help them fully understand the components of your strategy and how it impacts your overall plan.

Once your strategic legal plan is in place, we will deliver all original documents to you. We also provide electronic copies for you to keep in case you need to send copies to your other advisors.

PHASE 3

Legacy Support & Operational Assistance

The best-laid plans…often go awry.

Strategic legacy planning doesn’t just happen once. An effective family legacy needs iteration and refinement over time. After all, nothing in your life is static. Markets move, with potentially significant changes to your tax planning and the level of your wealth. Laws change, creating new challenges and new opportunities for leveraging your estate planning. The people impacted by your planning have evolving needs, requiring fresh focus and attention in your planning.

The frequency and intensity of periodic reviews depends largely on how sophisticated your planning needs are. For some folks a thorough review every two years is fine. For people with a complex series of strategies, business holdings, or strategic tax-leveraged plans, semiannual or quarterly plans are necessary. Other clients want us actively involved month-in and month-out to provide active operational support and to proactively offer new ideas and strategies. The main objective of a continuing engagement is to give your strategic legacy plan the maximum opportunity for success. That doesn’t happen by accident. Something as important as your legacy doesn’t work on autopilot.

We partner with you to set criteria for your plan’s success, and then design a continuing engagement to support your various legal strategies and provide ongoing operational assistance. The nature of a continued relationship will be uniquely tailored to your needs.